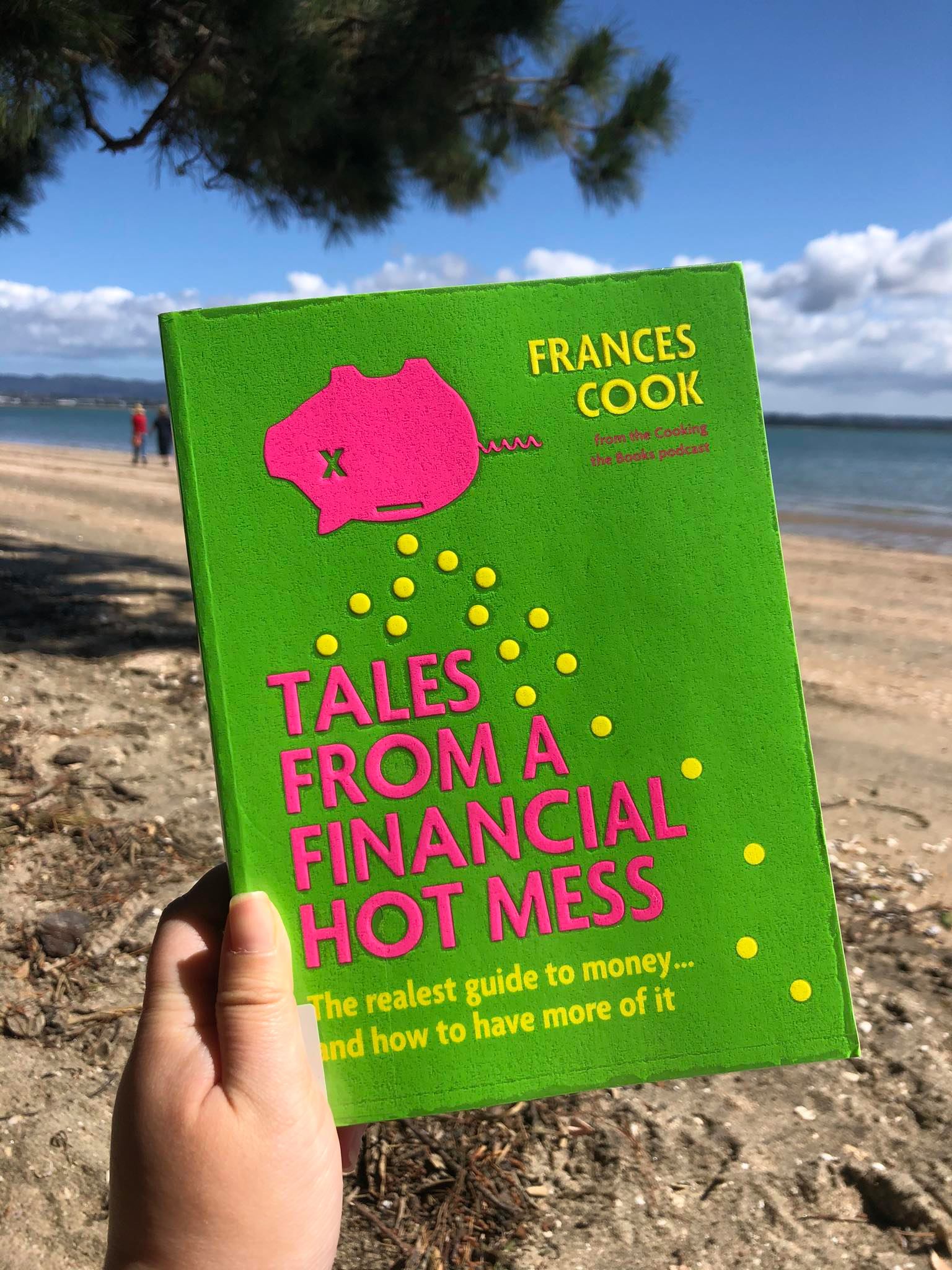

I’ve just finished reading this book called ‘Tales of a Financial Hot Mess‘ by Frances Cook and it is SO GOOD. She’s a Kiwi millennial journalist, and so I found the book SOOOO RELEVANT. All the tips were for real options in NZ, and the people she talked to I’ve also had some interaction with in work projects as well. It’s really inspired me to talk about my money goals and situation. She says, which I’ve been hearing sooo much of lately- about how people hate talking about money. people would rather talk about sex positions than money. I could go into detail about how my brazillian laser hair removal works to acquaintances, but I haven’t told anyone the details of my financial situation. Ever. She points out that it’s hard because our self worth is tied to how much money we have, and we’ve been programmed to be ashamed of having less.

But I actually really like talking about money. After all, how are we going to make more money, save more money, not make mistakes that other people have made with money if we don’t talk about it? As Frances says in the book, there is soo much money advice and tips floating out there. But it’s not until you hear a personal story from someone you know to really make an impact. So I don’t mind sharing my stories and mistakes, and the things I’ve learnt from life and the book.

Although I think I am a good saver, my weakness is stuff that’s on sale. I am not a minimalist. My biggest money mistake period was probably when I went on America on exchange. My parents gave me $13,000 NZD to cover insurance, living costs, travel, bills and spending money for 6 months.

I came back…. with around $400, and had withdrawn thousands from my own bank account during my time in NY. I went full YOLO before YOLO was a thing (I didn’t even have an iphone at the beginning of my trip, so I lost all my photos of foxes and squirrels that I took on my blackberry- ripoff phone), and went $illy.

I went on multiple hundred dollar shopping sprees in TJ Maxx, Forever 21 and Walmart, ate out and had Starbucks all the time, bought my first brand new iPhone and spent hundreds shipping back a box full of stuff as well as being stung at the airport for having overweight luggage. I waited months for the box to ship to me, which I lowkey think I paid my ex twice to ship the box – but you know what, if I did I owed him money anyway for the expenses I racked up for him lolol. I also had to pay for it to clear NZ customs. it all probably cost me around $400-$500.

After months of waiting, I had already forgotten what I had in the box. I was imagining it like a box of treasure. I got it in my arms, took a dozen selfies with my iphone to prove it’s arrival, peeled back the tape…

To find bullshit like free tshirts I had gotten, old clothes and textbooks, junk that I had thrown in (like $20 bright pink hair chalk that I still haven’t used) and freebie tourist crap. I had already bought back the things I realllyy wanted back with me in my luggage. Not only did I waste money and effort getting this box of crap being sent to me, I had wasted money buying this crap that was shoved in my face that I didn’t miss, want or need. I felt immensely guilty too, as it was hundreds of dollars that I could’ve saved for my parents. Even throwing it all away in America would’ve saved more money.

I vowed to never fall for buying cheap stuff overseas again. There will always be new clothes to buy, and a lot of touristy stuff you can order online. When I go on holidays now and when I went on a Contiki last year, I try my hardest to not accumulate possessions, as I don’t want to pay for overweight luggage fees again. If I buy something overseas, it needs to be special and planned for- it either had to specifically be only found from there, something where the currency exchange works out amazingly, or something extremely sentimental.

This resolution has really helped me not be so out of pocket from holidays, and just have less stuff to worry about in general. The holiday and experience itself is what’s making me happy, not a key chain that I’m going to keep buried in my drawer.

From reading her book, these are some new lessons I’m going to really try absorb into my attitude with money as well. And since I find them so achievable and positive, I have a really good feeling about it.

Making money goals

I think I’m a generally good saver. A representation of myself would be a small, chubby, tight-ass dragon hoarding all my coins. I LOVE nest eggs of money. I never buy clothes or makeup that aren’t on special, I tend to preload if I am going out and not buy drinks, and don’t get tempted to upgrade my car or technology. I hope this doesn’t come across as preachy though, because I definitely did not live the frugal lifestyle.

Some of my downfalls:

- makeup and beauty stuff that I don’t use

- clothes that I buy because they’re on sale that I sometimes don’t fit or that I don’t even like, but I like the pricetag

- kmart and chemist warehouse

- when ubereats offers me free delivery

- fast food

- eating out- $20 lunches was a norm

However, I’ve never been in a position where I couldn’t afford something, or felt threatened by an unexpected bill or change in living situation. I’ve never earnt that much either – for most of my working career I’ve never made over $50k. For a while, my freshly graduated younger brother earnt more than me.

This was because I had a money goal in mind – ever since I was 18, I wanted to buy a house and I was saving for a deposit. Since I’ve been so painfully single, I figured I would need to prepare to be able to afford it on my own. I am so, so jealous of people my age who are homeowners. Last year, I thought I was financially in a place where I could talk to mortgage brokers and looked at open homes despite me having gone on a $15k trip to Europe mid year. However, the only homes that I might be able to afford was in West Auckland. I was waiting outside a house to open, having taken 40 minutes to drive there, watching Westies yell at their kids and fix their cars around me (no shade – I’m a Westie) and was like … wtf am I doing this for??? I am a 25 year old who works in the CBD, loves eating out and being close to my friends and family. No one will visit me if I lived out here. I would have to find flatmates who wouldn’t mind not being close to central Auckland or public transport, worry about my safety as a single female living with strangers and in West Auckland… why was I intentionally trying to isolate myself and be in massive debt, to rush into living the suburban lifestyle which I didn’t find appealing???

I shelved the dream, thinking I was going to save more so I could build a deposit closer to 20% so I could borrow more money, and get a better house when I was thinking of buying again. However, thank FUCK I abandoned it now, because guess what?

Why do I have the time to read a book about finances on the beach at 2pm on a Tuesday?

I don’t have a job anymore!

That rainy day that they talk about, about saving for when your life changes unpredictably, it came. I had just spent quite a lot of money moving to a new flat, which was also came with higher rent. Auckland went into lockdown again for a few weeks, and I came out of it unemployed lol.

And honestly?? Not even stressed. Super, super happy, every day is a weekend and time doing what I want. Time to finally finish watching The Office, go to the beach, hang out with my friends and family and cook. I still have bills and rent. But I am truthfully not as worried as I could be because of a younger me trying to achieve my previous money goal. Thanks to that, I don’t need to scramble to find a job. I’m not desperate (yet), and my financial situation is not impacting my mental health right now. I am so glad that I didn’t try buy a house, or else I would’ve been fucked with a mortgage.

I am not so glad about all the money I’ve wasted that I could’ve used now. Before, I would spend a couple hundred dollars during a weekend on indulgences and impulses- clothes that were on sale, eating restaurant food I didn’t enjoy or groceries I would waste because it would go bad. A hundred dollars now could be food for me for a week, but instead it’s sitting at the bottom of the closet or filling a landfill.

I’m cutting anything that’s non essential. No clothes, no makeup, no shoes, no beauty products, no convenience (uber, fast food). I’m pulling a ‘we’ve got food (and coffee!) at home’ at myself.

Don’t spend on status symbols or to ‘show off’- the only one who looks dumb is you

I didn’t realise how much everything in our environment is designed to make us spend money. As a woman, it sometimes feels like you need to get your hair, eyebrows, nails and skin done, to wear makeup, to have clothes that you feel good in – that’s recurring $$$ to just EXIST, let alone do anything. We’re bombarded with not only advertisements, but also celebrities and our friends looking great on social media and forming this idea that you *need* to look a certain way, or try a certain thing. I have definitely existed, and been fine, without getting my nails professionally done or tried to fight against any hair on my body that wasn’t on my head. And yet I paid $1000 in January for laser hair removal where I now get naked every month in front of strangers for them to laser off hair from my neck down. I also have a wishlist of stuff I want that includes Lacoste sneakers and designer perfume.

Frances made me realise – that’s just all things. Things were I’ve been tricked that expensive means something, or that I need to look a certain way, because they want my hard earned money. The only person that even notices is me. What exactly am I trying to prove if I got expensive designer sneakers? No one would care, and even if they did, just how much is a compliment worth? I already have nice shoes and clothes, I can paint my own nails.

I can’t pluck my own eyebrows though, I’m a massive weenie. Have considered trying to self-wax them but I’m a weeeeeniieeee. I bought some hair removal cream for *sensitive areas* a while back (see?? why did I buy that when I was considering laser) that I’m contemplating using, and I try to be careful with a razor lolol.

3. Only spend on what brings me joy, or what I love

It has always annoyed me that every time I left my house, even if I was by myself. I would spend. On food, and the activity. And so much of it is mindless. Does eating kfc by myself make me happy? No. It normally makes me feel guilty afterwards. Having a coffee with a friend? Yes, the time spent with my friend is what makes me happy. I recently started pole fitness classes, and it’s been the only exercise I’ve enjoyed in my life.

I’m cutting out spending on anything that’s not essential but I will still spend on eating out with my friends (but to more cost effective places) and pay for pole fitness classes.

4. make my hard saved money work for me

I’ve worked really hard to save my money. And I’ve learnt now that chucking it into the bank, although relatively safe, does not help your money work for you.

Cash loses its value, and the interest you get is not that much. After doing Money Week at my previous job and reading this book, I was convinced – I really must be growing up now because I’ve bought SHARES. omg. Didn’t even understand anyytthhingg about the sharemarket this time last year and now I find it interesting and exciting. I’ve only put $20 for a few companies, and you can also invest in the top 50 companies in NZ or Australia – so I’ve done that. Currently all my shares have lost value except for one XD

But I think it’ll pick up again haha. It’s sort of a waiting game, where you wait for your shares to be high value, and that’s when to sell or you might start earning dividends. Apparently women lose less money than men in stocks since they’re more likely to sit and wait, while men are more likely to keep shuffling their stocks around. It’s also less risky to invest in an index fund, e.g. top 50 companies in NZ since it’s more likely and ‘right’ to assume most of them are going to make some money, and not in an individual company where it’s hard to predict how good or bad they’re going.

I do this all through Sharesies, which is aimed at millennials so it makes it real easy and has a nice layout. Also, they keep targeting me with their ads on social media. Sharesies, can you please remove me from your re-targeting??? I’m already a member!!! Have you guys watched The Social Dilemma? Scary stuff.

So yeah, I’m going to start watching my pennies even more, and with more goals! I wish I had started a bit earlier than this, but this has to be the most necessary time to start!

BTW THIS IS NOT FINANCIAL ADVICE. Do your own research and read the book haha it’s very good!

Well done Esther & lovely post. Good comments & sorry to hear about the redundancy but super glad to see your savings goals & habits working for you 🙂

Aw thanks for the nice words!! I feel like when I get a job again I’m going to look back and be like “remember when all I was unemployed and slept in everyday…” hopefully I can keep my positive attitude up ahaha 🙂 x